In the Persian Gulf countries, the cable infrastructure has ceased to be a secondary engineering element. Today, it has become the basis for the development of energy networks, urban construction, digitalisation and integration of renewable energy sources. The growth of investments in infrastructure projects, urbanisation, and the transition to new energy consumption models are radically changing the requirements for cable systems, materials, laying methods, and supporting components such as cable tray UAE solutions used for safe and structured cable routing.

Infrastructural Growth and Construction

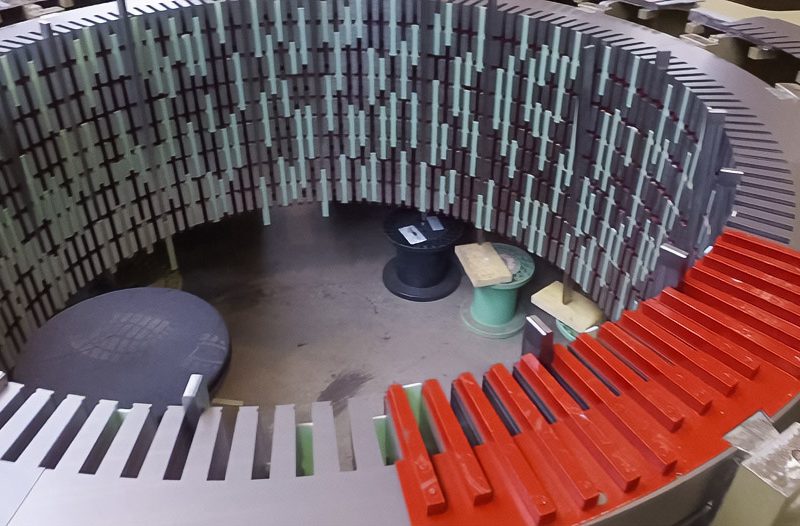

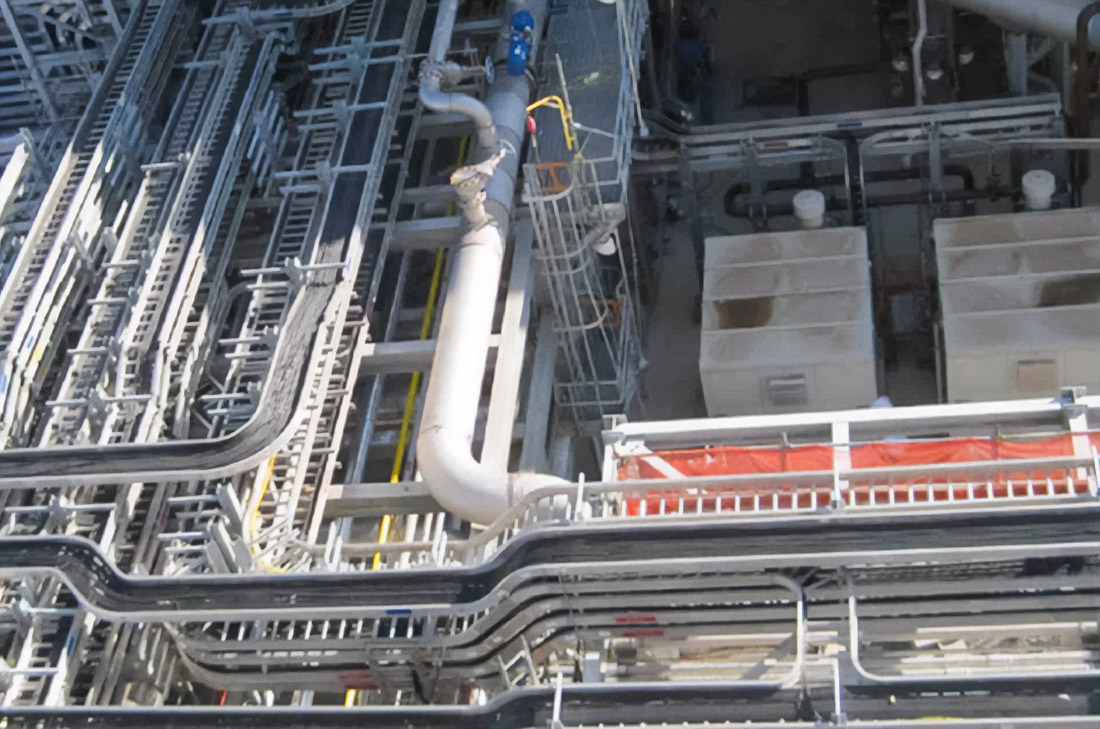

Large-scale construction projects ranging from residential areas to transportation hubs and industrial zones are generating steady demand for power cables and power supply systems. High-rise buildings, subways, railway lines, and urban infrastructure facilities require reliable solutions for energy transmission and distribution, as well as for control and automation systems. Alongside cables themselves, organised cable management systems provided by cable tray suppliers in UAE play an important role in ensuring accessibility, safety, and long-term operational stability.

In conditions of dense construction, underground cable laying becomes the preferred option. It reduces visual load, increases network reliability, and simplifies further upgrades. Aboveground lines are still used outside cities, and underwater cables are used to connect energy facilities and infrastructure across water barriers.

Power Grids and Energy Transition

Modernisation of electric grids has become one of the key factors of the market transformation. The expansion of energy transmission networks requires an increasing volume of high-voltage cables with a voltage above 66 kV, especially for long-range lines and the connection of large energy facilities. The average voltage in the 1-66 kV range remains the basis for industrial electrification, and low-voltage cables of less than 1 kV are widely used in residential and commercial construction.

The growth of investments in solar and wind energy increases the need for cable infrastructure capable of ensuring stable integration into existing energy systems. Load balancing, insulation reliability, and resilience to the climatic conditions of the region are critical for such projects. Plans for the development of renewable energy in the region are estimated at tens of gigawatts of installed capacity by 2030-2050, which directly affects the volume of cable supplies.

Digitalization and Data Transfer

Telecommunications infrastructure is developing in parallel with energy projects. The growing number of data centres and the introduction of 5G networks and Internet of Things systems create a steady demand for fibre-optic cables. Such cables provide high data transfer speeds, minimal signal loss, and stable operation of automation and monitoring systems.

The fibre-optic cable market in the region shows an average annual growth of about 8-8.5%, due to the expansion of data transmission networks and increased requirements for the reliability of digital services. A number of countries plan to digitalise up to 90-100% of public services by the period 2025-2030, which further increases the burden on telecommunications networks.

Materials and Technical Requirements

The technical characteristics of the cables are becoming a critical factor. Copper and aluminium conductors remain the main materials due to their electrical conductivity and mechanical strength. At the same time, the volatility of prices for raw materials – copper, aluminium and plastics – has a significant impact on the cost of projects and the timing of their implementation.

Increased attention is paid to fire safety, insulation standards and durability of cable systems. Large infrastructure facilities increasingly require solutions that meet international certification standards, which complicates logistics but increases the overall reliability of networks.

Regulation and Risks

Differences in regulatory requirements and standards between countries in the region create additional difficulties for manufacturers and suppliers. Inconsistencies in voltage, insulation, and fire resistance requirements can slow down the implementation of new solutions and increase certification costs. These factors directly affect the selection of both cables and cable tray UAE systems used in cross-border infrastructure projects.

At the same time, the overall market is showing steady growth. The total market volume of cable products in the region was estimated in the range of 3.6 to 5.4 billion US dollars in 2024, and by 2033 it is projected to grow to 9.8–12.5 billion dollars. The average annual growth rate, according to various estimates, ranges from 6.3% to more than 7%, and in some segments it is even higher.

Cable infrastructure in the Persian Gulf countries is becoming a key element of energy security, urban development and digitalisation. The growth of construction, modernisation of power grids, integration of renewable energy sources and expansion of data transmission networks form complex requirements for cable systems. In the coming years, reliability, compliance with standards, and the ability to operate under large-scale infrastructure loads will determine the choice of solutions for energy, construction, and telecommunications.

I am a Web Developer. I like to hike, crochet and play video games with my son.